[COVID-19 note: I wrote this before the virus took over our lives. It might not be relevant now, but M&A will always exist for things that make money or threaten a strategic.. So this will always be useful.]

In 2008 Johns Wu sold a pretty ugly looking WordPress blog for $12.4 million dollars. In 2020, a guy named Jack sold an email newsletter about cheap flights for $12 million dollars.

There’s no reason you shouldn’t be able to get good money for your business, too. I’ve put together this guide to put you on equal footing with the big guys.

Introduction/Who this guide is for

There are a lot of people out there running small to medium sized 6 and 7 figure (profit, not revenue) businesses out there on the internet. At some point in time, many of these people will consider selling their companies. Sometimes it’s the result of a well thought out process, but more often then not it’s the result of an inbound contact, a life event, burn out, boredom or some other reason.

When it comes time to sell, a lot of people don’t know what they’re getting into, who to turn to, and what to expect. A lot of the information tends to come from biased sources, or faceless people on reddit forums. Some of the good information gets buried in twitter. My goal with this post is to create a hub of information that can help you understand what’s involved in selling your online business.

I have primarily written this guide with an American audience in mind, which is why you will see references to the American Small Business Administration, Puerto Rico, and a few other American conventions. Almost all of the process/advice is still relevant regardless of where you live and where your business is domiciled.

What is an online business?

This post is kind of agnostic to your business model. It’s written for anyone who makes a living online, whether it’s through e-commerce platforms like Amazon FBA or Shopify, software as a service, lead generation, affiliate marketing, advertising, selling a service, arbitrage, and many more. I’m definitely leaving out tons of business models, but that’s kind of my point: it doesn’t really matter, because a lot of the selling process looks the same. The only thing that really changes is the multiple you can command, more on that later.

Important note on Hubris/This is not the gospel

I’ve been online for a long time. I’ve evaluated a lot of companies over the years, I’ve done due diligence for others, I’ve sold some of my own stuff. This post is primarily made up from my own experiences and the experiences of others I know. It is by no means the gospel on the matter. Please feel free to disagree with me (email me and let me know, too!), and take what helps you from this post. Do your own research and make your own conclusions. I’m just a random person on the internet.

Should you Sell Your Business?

Before we get down to the actual nitty gritty, I think it’s really important to consider if you should sell your business. Selling your business is a major endeavor unto itself and it quite literally will suck the life blood out of you. Think I’m joking?

- If you’re working with a broker you’re going to have to spend a lot of time getting the information they need for the packet they’ll release on your business.

- You’re going to spend countless hours on the phone with potential buyers. Many of them will ask the same questions. It gets old.

- You’re going to run around collecting data they ask for, even before getting an offer.

- You’re going to have to negotiate multiple LOIs (if you’re lucky!)

- Once you get an LOI, you’re going to go into Due Diligence. If the other side is any good, this Due Diligence will have you aching for a free massage from the TSA instead. Seriously – due diligence will take up so much of your time, unless you have been incredibly organized and process oriented from the get go. (HINT: If you’re running a 6-7 figure online business, you probably haven’t been and even if you are, you probably didn’t start out like that).

- If you have employees, they will probably be roped in at some point of the due diligence.

After all of this, there’s a huge chance that the deal still doesn’t close, in which case you either give up in agony or start the process all over again.

During all of this, your business is stagnating because you’ve been too focused on selling it to actively move it forward. Your blood pressure is up, you’re not sleeping well at night, and your spouse tells you you’re a lot more annoying then you were when you were just running the business.

Are there alternatives?

In his wonderful book, Before the Exit, Dan Andrews runs through several thought experiments that give a very different perspective on selling an online business.

I don’t want to take away from a great book, but Dan basically advocates looking at your business as platform for doing all sorts of things, and guides you through several alternatives to just selling your business:

- Are you selling because you’re burnt out or bored? What happens if you hire what Dan calls a mediocre manager? Someone to take over the day to day and you just cash the checks?

- Hidden platforms? Are you missing out on what selling your business might cost you?

If you’re at the stage where you’re considering a sale, I urge you to read the whole book.

Still want to sell, let’s talk valuations.

[H/T @BrentBeshore on Twitter]

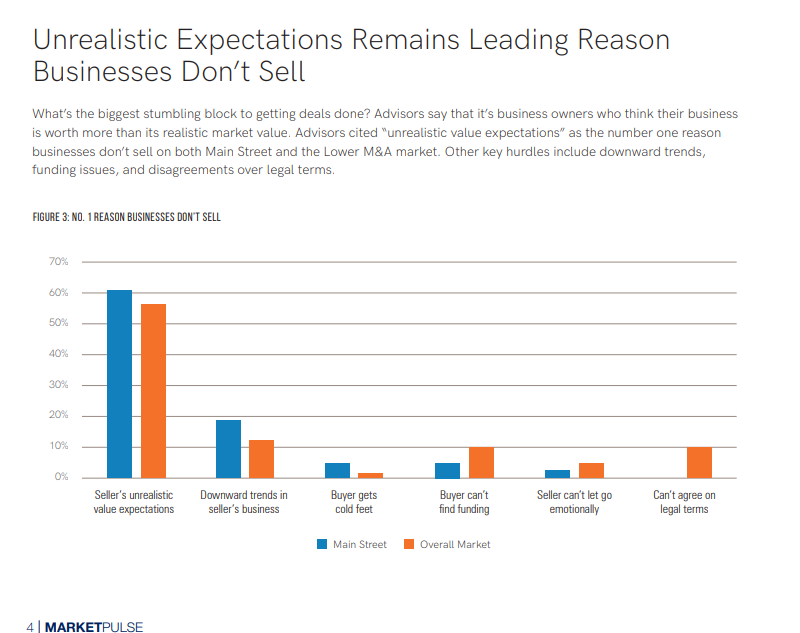

The number one reason most businesses don’t sell is because the seller had an inflated view of their business, not in line with market pricing. This happens for all sorts of reasons: A friend sold their business for $10 million so they think their business is worth the same; A bad appraisal/recommendation from their accountant; or just the “magic” number that they need in order to retire/exit the business.

Regardless, if you really want to sell your business you need to have a really good understanding of what the actual valuations are in in your little corner of the internet.

How Much Do Internet Businesses Cost, Anyway?

I could give you the standard spiel of 3-5x TTM earnings as the baseline for most sales, but I don’t think that’s 100% fair or correct. There are all sorts of exceptions and weird edge cases and a lot of it depends on who the buyer is, how desirable the vertical is, your current growth, and how much of the market you own.

All things being equal, a network of dominating credit card affiliate sites will probably command a higher multiple then a similarly sized hair extension e-commerce play.

A lot of this comes down to timing, external factors (is your acquirer trying to get acquired?), the general economy and so many things beyond control:

My favorite example is the BankaHolic sale in late 2008:

One guy (Johns Wu), running a wordpress blog about bank deals, sold it for a 12.5 million up front and another 2.9 million earn out (which, based on the market crash a few months later, I doubt he got). So much of that sale had to do with right place, right time (SEO 11 years ago, BankRate’s need to grow, the market not yet crashing).

OK, but how do I figure out my price?

There’s no right way to figure out the perfect valuation. Even if you’re not going to use them, talk to a few brokers who have sold similar sites before to get some feedback from them. Look at similar public listings that have closed or are currently for sale to get an idea of multiples that will actually sell. Take a look at public companies to see what recent transactions they’ve completed – if you know your industry you can usually figure out what multiple they paid.

An Important Note about Copycats, Imitators, and Trade Secrets

If your business moat is operating online in a niche no one knows about, realize that this will change as soon as you list your business.

Let me give you a more concrete example:

If you operate a network of e-commerce websites in the hair extension niche, with traffic from PPC/SEO/Social, and your main advantage is that you don’t have that much competition, you will get 3-5 new competitors within six months of listing your business for sale.

Have a weird Amazon FBA product that no one has discovered yet? That goes out the window as soon as you try to sell.

It sucks, but it happens. It’s less of a problem if you run an entrenched business with multiple moats (e.g. long contracts, unique products, brands, relationships, etc) but I want to put it front in center. I don’t think it should stop you from selling your company but I think you need as much data as possible in order to do effective risk management.

Getting Ready to Sell Your Online Business

Ideally, getting ready to sell your business starts years before you decide to sell your business. .In other words, every improvement you make to your business (especially how it runs) makes it easier for a buyer to step in and take it over.

In a more concrete sense, it means improving your business operations and financial management.

I had a whole section here on how/what to do this, but the folks at Permanent Equity have a much better article on the same subject called: Table Stakes. The nice thing is that even if you decide NOT to sell, answering and working on the questions posed will dramatically improve your business.

Who should sell your business – You or an Intermediary?

Now that you’ve gotten your house in order, the next question is how you’re going to find a buyer. There are generally two methods, very similar to selling a house: you can either list it yourself or list it through a broker. I know that there’s a third option – you received an unsolicited offer from a vendor, competitor, random person, strategic acquirer etc. Even in those cases I often (but not always) suggest trying to get more potential bidders in order to create the competitive auction process. If you already have a deal in place and just want to read about the anal cavity search due diligence/sale process, scroll down.

Doing it Yourself

Pros:

- No broker fee

- Direct interaction with potential buyers from first inquiry

Cons:

- You have to do ALL the work yourself

- The selling process at this early a stage, will totally consume you.

- Direct interaction with potential buyers from first inquiry

As a buyer, I’m always happier to deal directly with sellers. I also know plenty of people who have done great deals with out going through a listing process. All that said, and I’m shooting myself in the foot here as a buyer, you’re probably better off listing with an intermediary.

WTF are intermediaries?

Intermediary is a nicer way of saying middle man or broker. In the world of buying /selling companies, we usually call them Business Brokers or Investment Bankers. Business Brokers primarily work with what are called “Main Street” companies, while Investment Bankers work with Lower Middle Market and up. (What’s the difference? Mainly revenue and profit) Investment bankers can also offer other services such as facilitating majority/minority recaps, debt funding, and other financial engineering, but that is beyond the scope of this post.

Why do I think you should use a Broker/Banker?

If you pick the right broker [more on that in the next section], you can dramatically increase your chances of getting your company in front of the right people. If you have a high quality asset, you might even be able to get a bidding war going on. Brokers also can (in theory) protect your time – shielding you from tire kickers, answering the same questions over and over again.

Most importantly, a good broker will have an existing audience and relationships with buyers who want to buy your company. To me, this is where a good broker brings real value. The difference between, no exit, a mediocre exit, and a great exit is often who sees the asset for sale.

A Brief Rant on Choosing the Right Broker

For the love of God, please choose a broker who actually specializes in online businesses.

This drives me nuts. I’ve seen multiple high quality online businesses that were listed with local brokers and didn’t sell. I’m convinced they didn’t sell because the broker didn’t have the right audience. [I found them through a bunch of deep dives]. The guy selling local restaurants, manufacturing companies and HVAC should not be selling a SaaS company [true story].

It doesn’t matter if you have a relationship because of something unrelated to work, or your buddy sold his moving company through them for a great price. You need to sell your company through someone who has the audience for your asset, understands the business model and knows how to price it.

I’m not bashing the local broker. But you wouldn’t go to a Podiatrist for plastic surgery on your face, even if he was your best friend, right?

Broker Incentives

In theory, the incentives with brokers are pretty well aligned. They only get paid on a completed sale. In practice, it’s more nuanced. They want to sell, even if the price is not as great as they thought it would be. Maybe they’ll push you to accept terms you don’t like because they want the deal to close so they can move on to the next one.

My point is always try to see the whole picture before agreeing on a deal. Most of the brokers I know are good people, but I always think about Charlie Munger when it comes to incentives:

“Never, ever, think about something else when you should be thinking about the power of incentives.”

— Charlie Munger

A Few random notes on working with brokers, questions to ask, etc:

Before you hire a broker, these are questions I suggest asking:

- How many businesses similar to mine have you sold in the past year?

- What was the actual price point of each one sold, and multiple? How long did each one take to close?

- How big is your audience for my segment of the marketplace? In other words, are the majority of their audience targeted towards SaaS or e-commerce, for example. Brokers can get pretty niche.

- Off the top of your head, can you think of 3 buyers you’ve worked in the last year, whom might be interested in my business?

- Are most of your buyers one off or do you work with repeat acquirers? Ask them if they can break this down.

- How many businesses did you list but not sell this year?

- How many of those went under LOI but failed to close?

- How many failed to get any offers at all?

- Where do most of your buyers get their funding from? Some brokers seem to have an audience that is more backed with SBA financing then others, for example.

- What’s so special about your company vs all the other brokers. Typically, you’ll get a sales pitch but occasionally you’ll get some interesting nuggets of information.

- At what point are you going to spam Biz Buy Sell with my listing? This will probably piss off the broker, but you need to know as a seller who will see your business listing.

- List your conflicting interests. List any other businesses you own. A lot of online brokers either operate other online businesses or have equity interest in them. This goes for Investment Bankers too. If you run a hair extension business and your broker owns 25% of your competitor, probably time to list elsewhere.

A brief interlude on what you’re looking to achieve in the listing process:

Before we go forward on how to list your business, let’s discuss the whole point of listing:

The goal is to create a competitive auction for your business between qualified bidders to get the maximum value for your business.

I should clarify that is the main goal. Often, though, you might have other issues important to you that qualify this goal:

- you want to make sure your customers get a good home and are treated well

- you want your employees to be treated well at their new employer

- you want to make sure your baby continues to exist.

What Happens when You List

I’m going to assume you’re listing with a broker or banker. If you’re not, the steps are pretty much the same except you have to do all the work yourself and you probably won’t be as polished.

- Gather financial data.

- Create Profit and Loss for your broker or provide them with existing financials

- Broker stands over a magic cauldron whispering “add backs, add backs, SDE, EBITDA!” and your profit grows to way more then anything you ever actually had in your bank account. I will write another post about the magic of add backs and SDE/EBITDA in the future. SDE/EBITDA is great for sellers.. Just remember, you can’t eat EBITDA.

- Broker creates info package (called a Memorandum, Confidential Investment Memorandum/CIM, Package, and many other sundry names)

- Broker lists your business for sale on their listing pages. If they’re a good broker they pull targeted names from their audience and email them.

- If you’re working with an Investment Banker it’s a little bit more polished or aristocrat like. There’s not a listings page, but instead potential acquirers will be contacted with discretion in the hopes of creating interest.

- Your broker screens potential buyers (for various levels of effectiveness), gets them to sign an NDA which is more about making sure the broker gets paid then it is about protecting confidentiality, and sends them an info packet.

- If there’s more interest usually there’s a call, follow up questions, etc.

- Hopefully you get a number of Letter of Intents, and now it’s time to choose one. Let’s cover the LOI process.

LOI

An LOI stands for Letter of Intent. On a very basic level it indicates a serious offer from a potential buyer. Typically, it’s a document from a buyer to seller outlining initial terms of the sale including a price. It also usually includes an exclusivity period, during which time you can’t shop the business any more while the seller does due diligence in advance of the actual sales contract. When you see a listing “under offer”, it means the seller has accepted an LOI.

Let’s be super clear: unless your buyer is an idiot, the LOI is not binding except for the exclusivity. The goal of the LOI is to (in theory) agree on the price and major terms, and begin commencing all of the steps needed to get to an actual contract, primarily due diligence. No buyer wants to do due diligence if they can’t buy the business afterwards.

I say in theory because there all sorts of shifty people out there, and I think as a seller it behooves you to understand some of the games buyers play when they send out LOIs:

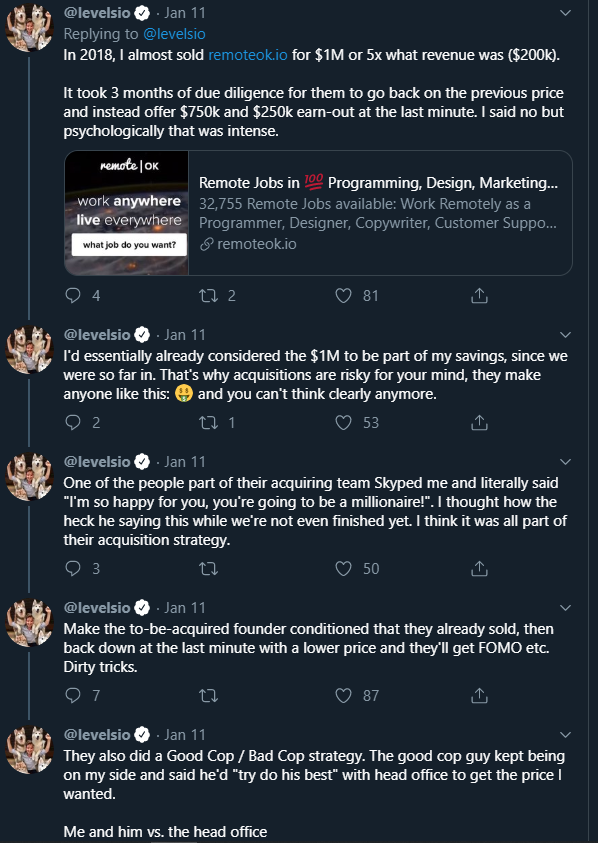

Game #1: The Psychological Assholes

These guys will name any price you want and go all the way down through due diligence. There won’t be any major issues brought up, until it’s time to send the contract for final signing. At this point, some major flaw is suddenly discovered, and either the price drastically changes, or they ask for a seller note way higher than you initially agreed, or some combination of the two.

You’re so drained from the whole process, and you’re so emotionally tied to the sale, that this probably works 40% of the time.

The founder of remoteok.io and NomadsList had this happen to him:

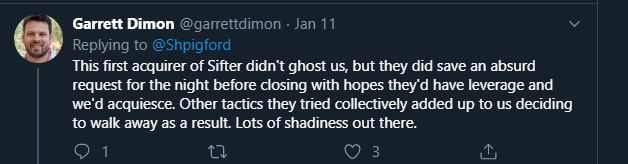

Garrett Dimon mentions someone who literally read this playbook and waited to the night before closing for leverage:

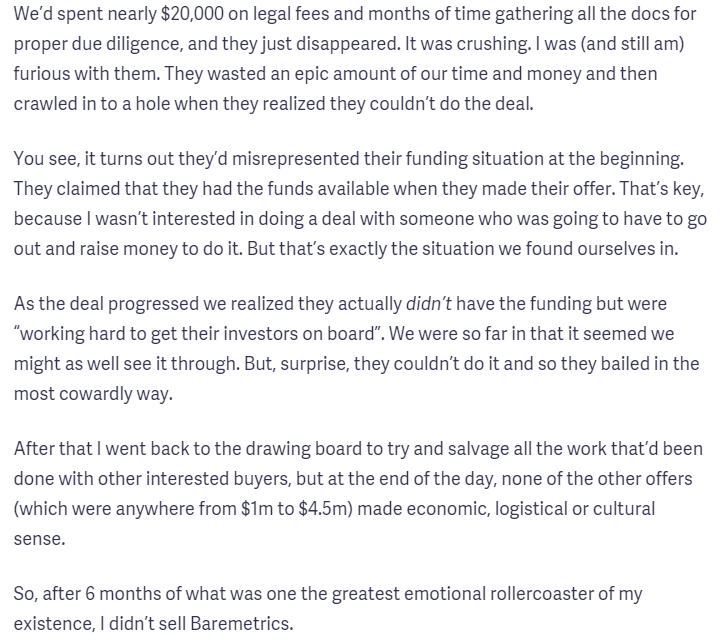

Game #2: We don’t actually have any money, yet

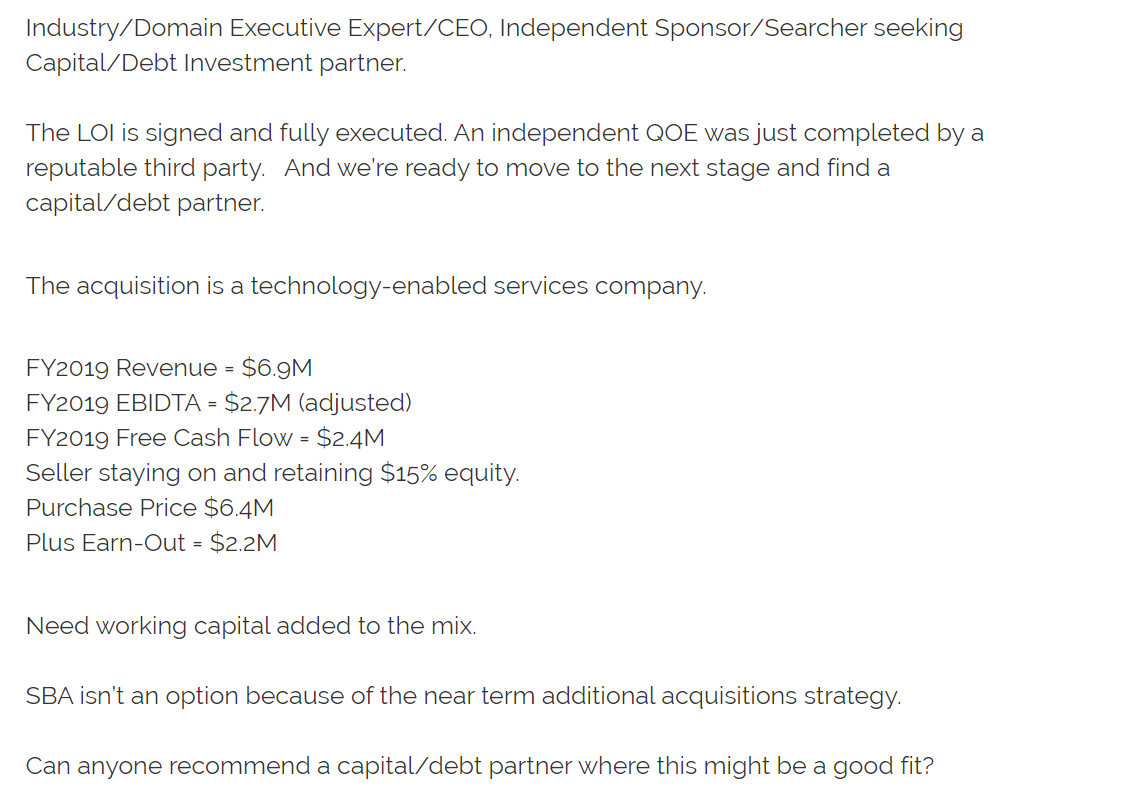

This is so common that it actually has a name in the finance world, it’s called Independent Sponsor. You go through countless hours of due diligence, and at the close the buyer doesn’t have the money because they’re still out raising it from backers.

Josh Pigford of Chartmetrics talked about this openly:

Don’t let this type of person be your buyer:

Game #3: We’re just here to steal all your info

This is very common in M&A. The buyer never really wanted to own your business they just wanted to do a deep dive so they could replicate it inhouse.

Trust, but verify

I am not trying to scare you off. Plenty of successful people have exited their businesses. I just want to level the playing field and make sure have an idea of what can happen.

Before you agree to an LOI, you can ask the buyer all sorts of questions. Your broker should be doing this as well but they are not always on top of this. Also, people bullshit all the time, so asking a few times catches them in half truths.

- What are your source of funds? (I have seen larger deals where the answer was basically a *shrug*, and the deal still went through).

- Do you have investors? Have they committed the capital already? Alternatively, you can ask if they’ve done any capital calls or if this is their first one.

- Are you using SBA Debt? Are you pre-qualified for SBA Debt? (As a seller, I promise you your broker will check to see if your business is underwritable with SBA debt, so I’m not even going to talk about that).

- What other sources of debt are you using?

- Have you ever done a deal before?

Due Diligence

The LOI is now signed, your business is now considered to be “under offer”. But don’t start counting the money just yet. It’s time to get rectally probed , undergo due diligence. If you asked me to summarize due diligence in one line:

The Buyer goes through everything the seller has done with a fine tooth comb in order to verify everything the seller has presented is, indeed, true.

I am not going to list what a full diligence looks like but suffice to say if you don’t have your ducks in a row, this is going to be a giant time suck.

Here are just a few of the things that are going to come up:

- Your business (think corporate papers, properly filed returns, etc)

- Your accounting (do the transactions match up to what’s in your bank account – are you really making and spending as much/little as you claim)

- Traffic quality/risk – the buyer (hopefully) will take a deep dive into your traffic generation and make sure everything you are doing to get traffic (SEO, PPC, Content Marketing, App Store etc etc etc) is both kosher and sustainable.

- Your employees and vendors – are they going to stay on? Are they everything you claim?

- Your IT Setup – especially if you’re a SaaS, get ready to get your code examined with a fine tooth comb.

- Pretty much everything you’ve ever done in your business is going to get looked at.

The Many Exceptions to DD in the online space:

Not all online businesses will undergo the same levels of Due Diligence. I have seen many six figure deals that were based on verification of traffic and revenue and nothing else. So much depends on the type of deal you’re doing, who you’re doing it with and the cost of the deal.

Generally speaking, as either the complexity of the type of business or the amount of money involved rises, you can expect to see more complex and thorough due diligence.

Please be upfront and honest

Almost all Businesses selling in the main street (under 5 million) range have issues. The slang term for this is a “Business with hair on it”. No one is expecting that you’ve done everything perfectly, or that there were no hiccups along the way.

Please just let the seller know before they even start Due Diligence. We’ve had issues x,y,z in the past or we do this now differently because of some legal problem we fixed.

I can you promise you a few things:

- People appreciate being upfront and honesty

- 95% of the time it’s going to be found out anyway

- If you don’t disclose and it comes up post sale, there’s a good chance you’re about to get sued.

The worst thing that can happen when you disclose is that the buyer backs out. While not ideal, it’s always important to remember:

- There was a very big chance this deal was never going to close anyway

- There are other buyers who have different risk profiles

I have seen 8 figure deals go haywire because the sellers were not upfront about changes they had made and what they were doing, and it was the straw that broke the camel’s back. The group who was buying was already having enough issues with the seller, and the lack of honesty just killed whatever goodwill was left, and the deal along with it.

Signing an Agreement

Along-side due diligence, you’re probably going to negotiate the actual contract as well. The contract is the actual, legally binding deal between you and the buyer. There will be things in there not discussed in the LOI. Items may be added or changed depending on what comes up with Due Diligence.

Some buyers will try and use this time as leverage to get a better price or terms. You have emotionally invested in the LOI and now just want to get the end. I’d love to say “Stand Your Ground” but every situation is different in terms of what kind of negotiating strength you have.

So my advice is: be rational, take a deep breath, look at your other alternatives and figure out if it’s a big deal, or just a quibble you can deal with.

Negotiation in general is an art to itself, managing everyone involved in the negotiation is an art (especially the lawyers). I’ll leave some useful books in the resource section below.

Post Sale – Now What?

Wow. You’ve beaten the odds and actually sold the damn thing. Congratulations! Now what?

My advice? Do nothing for a few months.

A very large sum of money has just hit your bank account, but keep in mind that the cash flow is no longer there.

Put aside what you’re going to owe in taxes. The government will want their share, unless you live in Puerto Rico.

Don’t go crazy. You’re going to feel flush and it will be very hard not to spend a lot of it all at once. Don’t.

If possible, avoid letting the world know. Relatives, long lost friends and “advisors” will come crawling out of the wood work.

Should you reinvest/become an investor?

There’s this weird thing where tech/online entrepreneurs who have exited suddenly become Angel Investors or immediately start buying another business.

Your qualifications as an entrepreneur are not the same qualifications needed to be an Investor/Capital Allocator They are different skill sets that require education and experience.

Also, there is a huge element of luck and timing in selling your business. Please don’t blow it all on investments that are more status symbol then sensical.

If you still want to go down this road, especially the Angel road, take some percentage of your money earned from the sale. That’s the maximum you can invest, and not a penny more. There is significant risk and the odds are not always in your favor.

Summing Up

Selling your business is a grueling event that will suck all of your emotional energy but potentially make you very wealthy. Recognize the psychological games, the risks in the process, and make a decision. If you decide to sell: Take a deep breath, surround yourself with the right people, and get ‘er done.

Resources/Further Reading

Before the Exit by Dan Andrews

The Messy Marketplace from Permanent Equity

http://trevormckendrick.com/how-i-sold-my-bible-app-company/